U.S. retail sales barely increased in May, with previous month data revised significantly lower, indicating sluggish economic activity in the second quarter. The Commerce Department reported a smaller-than-expected rise in retail sales, partly due to lower gasoline prices affecting service station receipts. Inflation and higher interest rates are challenging consumer resilience, with households prioritizing essentials and reducing discretionary spending. Despite tepid retail sales, economists anticipate that the Federal Reserve may still begin cutting interest rates in September, though central bank officials recently suggested a possible delay until December.

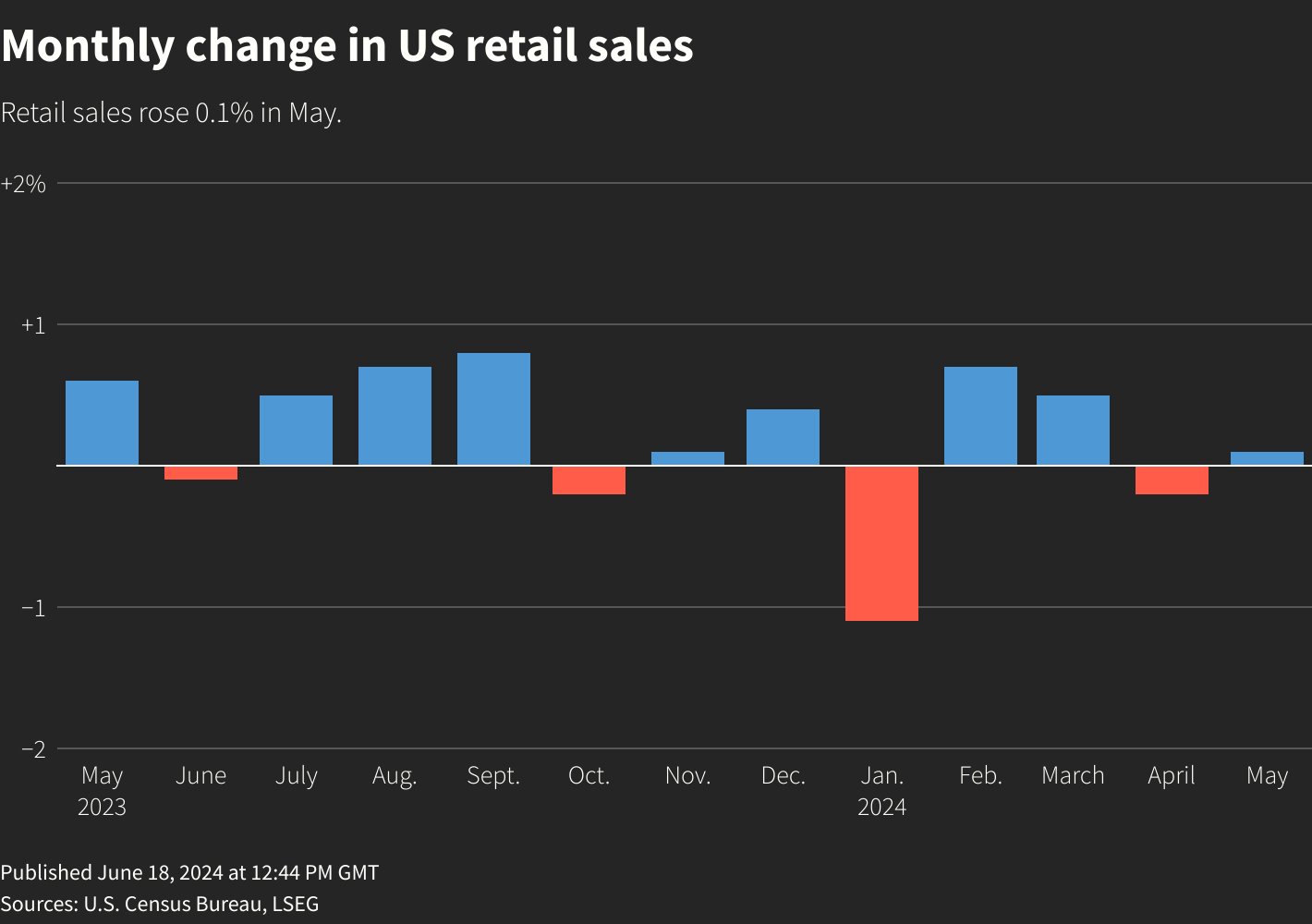

Paul Ashworth, chief North America economist at Capital Economics, noted that the modest slowdown in consumer spending and GDP growth could prompt the Fed to consider a rate cut in September. Retail sales rose 0.1% in May after a downwardly revised 0.2% drop in April. Economists had forecast a 0.3% gain. Inflation-adjusted retail sales increased 0.4% last month, following a 0.3% decline in April.

Retail sales trends have been affected by factors such as an early Easter and tightening credit access, with lower-income borrowers struggling to keep up with loan payments. While the labor market remains strong, finding new jobs has become more challenging, and wage growth is slowing. Savings have also dwindled, though spending levels are still sufficient to sustain economic expansion.

The Fed maintained its benchmark overnight interest rate in the 5.25%-5.50% range, projecting only a single quarter-percentage-point reduction this year. Financial markets expect the Fed to start its easing cycle in September. Wall Street stocks were higher, the dollar slipped, and U.S. Treasury yields fell.

The retail sales report showed mixed results. Gasoline station sales dropped 2.2%, building material and garden equipment store sales fell 0.8%, and food services and drinking places sales decreased 0.4%, the largest drop since January. Conversely, motor vehicle and parts dealers saw a 0.8% rise, and online store sales increased 0.8%. Sales at sporting goods, hobby, musical instrument, and book stores rose 2.8%, while electronics and appliance outlets and clothing retailers saw gains of 0.4% and 0.9%, respectively.

Core retail sales, excluding automobiles, gasoline, building materials, and food services, rose 0.4% in May after a downwardly revised 0.5% drop in April. This trend corresponds with the consumer spending component of GDP, prompting Goldman Sachs to trim their second-quarter GDP growth estimates from a 2.1% annualized rate to 2.0%.

Manufacturing showed promising signs, with output jumping 0.9% in May following a revised 0.4% drop in April. Durable goods manufacturing production increased 0.6%, while nondurable manufacturing production surged 1.1%. Ian Shepherdson, chief economist at Pantheon Macroeconomics, cautioned that growth in manufacturing output would likely be incremental in the second half of the year, with high interest rates and a strong U.S. dollar dampening business investment and external demand.

READ MORE: