Investors flocked to tech stocks at one of the fastest rates this year, following the Federal Reserve’s decision to cut its benchmark interest rate for the first time since 2020. The Nasdaq surged 2.5% on Thursday, its fourth-largest rally in 2024, led by a 7.4% rise in Tesla shares and a 4% jump in Nvidia. The tech-heavy index hit its highest level since mid-July, closing at 18,013.98, just 3.5% below its peak of 18,647.45 reached on July 10.

Tech stocks generally benefit from lower interest rates, as reduced borrowing costs and bond yields make riskier investments more appealing. The Federal Open Market Committee indicated further rate cuts, suggesting an additional 50 basis points reduction by the end of the year, and potentially a 2% drop beyond this recent move.

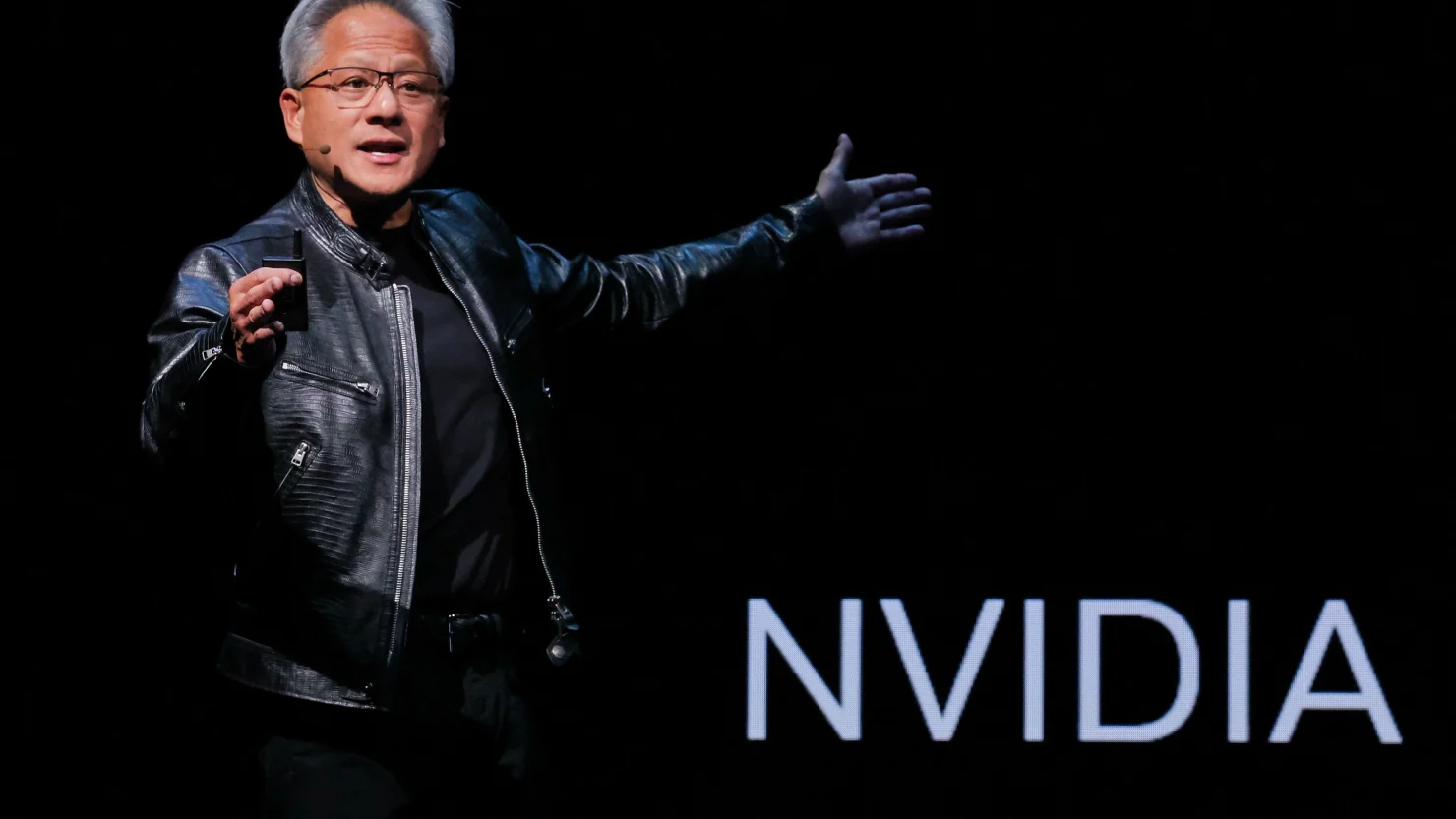

Nvidia, a key player in the AI sector, saw its stock rise to $117.87, up about 138% for the year, despite being 13% below its all-time high in June. The company’s processors are integral to the development of generative AI, powering services like OpenAI’s ChatGPT. Nvidia’s strong performance is tied to a small group of major clients, including Microsoft, Meta, Alphabet, Amazon, Oracle, and OpenAI, which rely heavily on its technology for AI workloads and large language models.

Fellow semiconductor companies Advanced Micro Devices (AMD) and Broadcom also experienced gains, rising 5.7% and 3.9%, respectively. AMD is positioning itself to compete with Nvidia in the AI space, but it currently lags behind and faces skepticism from some analysts. AMD’s stock has only increased by about 6% this year. AMD CEO Lisa Su emphasized the long-term nature of AI’s impact, noting that the industry is still in its early stages. “Tech trends are meant to play out over years, not over months,” Su said, highlighting that AI will eventually influence all areas of life, including education and healthcare.

Tesla was the standout performer among major tech companies on Thursday, surging 7.4%. Despite being down nearly 2% for the year compared to the Nasdaq’s 20% gain, the electric vehicle maker has rebounded 72% from its April low. The recent uptick reflects renewed investor confidence in Tesla’s long-term growth prospects.

Other tech giants also saw substantial gains, with Apple and Meta both climbing nearly 4%. The rate cut has bolstered optimism across the sector, as investors anticipate a more favorable environment for high-growth companies. The renewed enthusiasm for tech stocks, particularly those with strong positions in AI and innovation, suggests that the sector could continue to see robust performance as interest rates decline further.

READ MORE: