Comcast CEO Brian Roberts recently conveyed a clear message to Warner Bros. Discovery CEO David Zaslav: acquisitions are not on his agenda. During Comcast’s second-quarter earnings call, Roberts emphasized focusing on organic growth opportunities like the NBA rather than buying content companies.

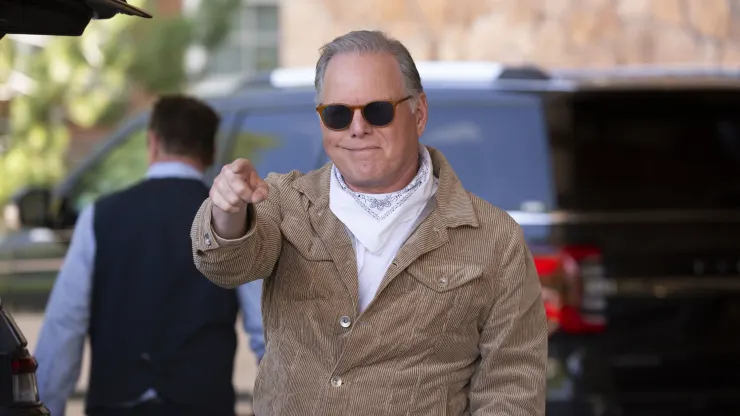

Meanwhile, Zaslav has publicly voiced a concern shared by many legacy media executives: stringent government regulations have stifled deal-making. He hopes for a future administration that will ease these restrictions, allowing companies to consolidate and strengthen their positions.

The disparity between Roberts’ reluctance and Zaslav’s call for deregulation highlights a crucial question for the media and entertainment industry’s future. Do major media and tech companies avoid acquisitions due to regulatory fears, or is there simply a lack of interest in these assets?

Paramount Global’s recent sale process, involving numerous potential buyers but culminating in a deal with the smaller Skydance Media, suggests a lack of interest from major players. Similar struggles have been faced by companies like Starz, AMC Networks, and Vice Media in finding buyers.

Rob Kindler, global chair of M&A at Paul, Weiss, offers two plausible explanations: either the assets are undesirable, or the regulatory hurdles are too high. A push towards deregulation could provide the industry with much-needed clarity.

Zaslav, drawing from his experience extending Discovery Communications’ lifespan through a merger with WarnerMedia, sees consolidation as essential for survival. However, recent media mergers have not fared well. Warner Bros. Discovery’s market capitalization has fallen to around $20 billion from a peak valuation of $43 billion, with substantial debt remaining. Other significant deals, like Disney’s acquisition of Fox assets and Comcast’s purchase of Sky, also show diminished returns.

While these mergers haven’t proven successful, it’s crucial to consider their alternatives. Independent media companies, like AMC Networks and Lionsgate, have struggled significantly, with their stock values plummeting.

Regulatory concerns undeniably play a role. The current environment requires initial consultations with legal experts rather than financial advisors, reflecting the heightened scrutiny of mergers. There is uncertainty about whether a change in administration would significantly alter this landscape.

Mark Boidman, head of global media at Solomon Partners, argues that despite the regulatory environment, deals are still happening across the media industry. FTC data indicates that only a small percentage of mergers fail due to regulatory issues. However, the volume of media deals has noticeably declined, suggesting a cautious approach from legacy media companies.

In conclusion, the media and entertainment industry’s future hinges on navigating regulatory complexities and market dynamics, with leaders like Roberts and Zaslav at the forefront of this evolving landscape.

READ MORE: