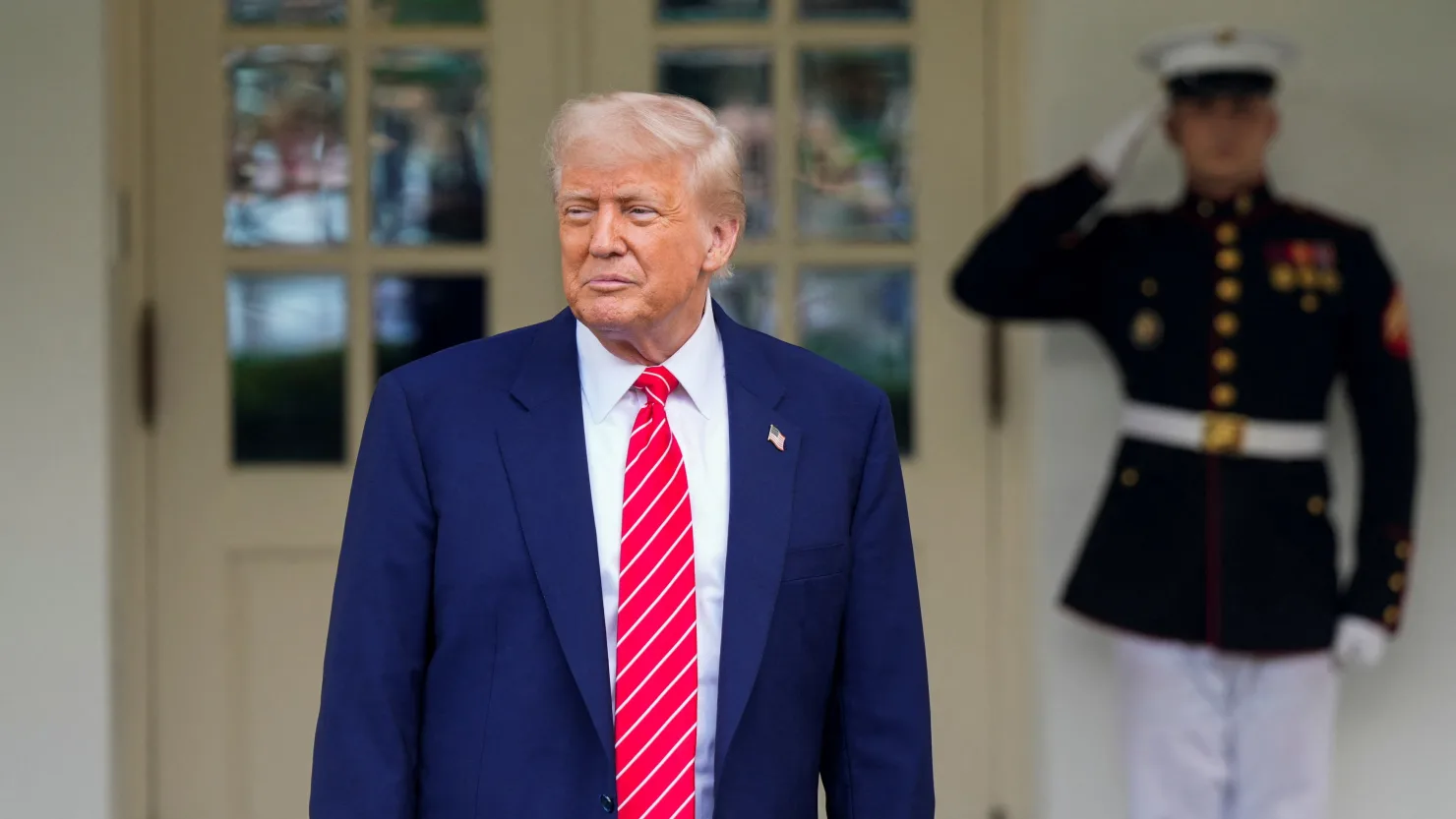

President Donald Trump’s personal involvement in cryptocurrency is creating significant obstacles for advancing federal legislation on stablecoins. This week, the Senate failed to pass the GENIUS Act, a bill designed to introduce a regulatory framework for stablecoins—digital currencies pegged to assets like the U.S. dollar. The bill fell short of the 60 votes needed to move forward, with a final tally of 48 in favor and 49 against, and three senators absent.

Key to the bill’s failure were growing concerns about potential conflicts of interest stemming from the president’s own crypto ventures. Since launching his $TRUMP meme coin earlier this year—reportedly worth billions on paper after promotional efforts including exclusive dinners and White House tours—critics have labeled the move a pay-for-play scheme. First Lady Melania Trump has also introduced her own coin. More troubling for lawmakers is World Liberty Financial, a Trump-linked venture that launched a stablecoin as the administration began pushing for looser digital asset regulations. The coin is reportedly involved in a $2 billion investment from Abu Dhabi-based MGX into Binance, raising further conflict of interest and national security concerns.

Senator Jeff Merkley voiced alarm over the president’s ability to personally profit from cryptocurrency, calling it a corrupt and dangerous precedent. Multiple Senate Democrats who initially supported the GENIUS Act withdrew their backing, citing inadequate provisions on anti-money laundering, foreign issuer risks, and financial transparency. Senator Lisa Blunt Rochester criticized what she termed “ongoing self-dealing” by the Trump family, while Senator Richard Blumenthal called for an investigation into Trump’s crypto holdings and potential abuse of White House access to drive up the value of $TRUMP.

Efforts to replace the failed bill are already underway, with Democrats introducing the “End Crypto Corruption Act” to block public officials and their families from issuing or endorsing digital assets. The White House has defended the president’s actions, claiming full compliance with conflict of interest laws. Still, some crypto industry leaders argue that Trump’s private dealings are derailing progress on policies that could bring long-overdue regulatory clarity. Without bipartisan consensus and the removal of personal business interests from the legislative process, they warn, the U.S. risks losing its chance to lead on global crypto innovation.

READ MORE: