In an era dominated by venture backed platforms and billion dollar technology companies, some of the most unexpected success stories are still emerging from online communities built around trust rather than scale. One such example is SWAPD, a forum based marketplace that began as a niche community and has since facilitated more than 60 million USD in digital asset transactions.

What started as a small discussion forum for buyers and sellers of online assets has evolved into a structured marketplace operating as a Merchant of Record, offering escrow, dispute resolution, and compliance focused transaction flows. The growth of SWAPD highlights a broader shift in digital commerce, where community driven platforms are proving capable of generating substantial economic activity without the traditional trappings of Silicon Valley startups.

This is the story of how SWAPD grew from a simple forum into a high volume marketplace and what its trajectory reveals about the future of online trade.

Origins in a fragmented market

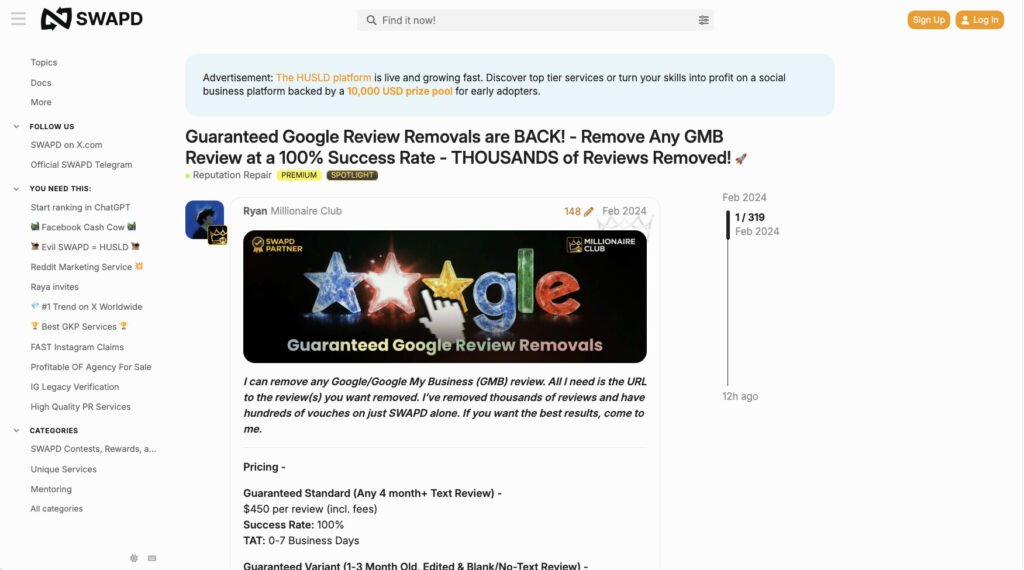

Before platforms like SWAPD existed, the buying and selling of digital assets was highly fragmented. Social media accounts, usernames, domains, websites, gaming profiles, and monetized channels were traded across private messages, chat groups, and informal brokers. While demand was strong, infrastructure was weak.

Transactions often relied on personal trust, screenshots, and verbal assurances. Scams were common, disputes were difficult to resolve, and there were few standardized practices for valuation or delivery. Despite this, the market continued to grow, driven by the increasing value of online identities and digital reach.

SWAPD emerged to address these gaps. Rather than launching as a polished marketplace, it began as a forum where buyers and sellers could openly post listings, ask questions, and build reputations over time. The emphasis was not on aggressive growth, but on moderation, verification, and accountability.

This approach attracted a specific type of user. Many early participants were experienced traders who understood the risks of informal deals and were looking for a safer environment. Over time, the forum developed its own norms, rules, and internal governance, laying the foundation for what would later become a full scale marketplace.

Reputation as currency

One of the defining features of SWAPD was its reputation system. Every transaction, interaction, and dispute contributed to a public record attached to each user profile. This created strong incentives for good behavior and long term participation.

Unlike anonymous marketplaces, SWAPD made identity and history central to trust. Sellers with proven track records commanded higher prices and closed deals faster. Buyers who acted in bad faith found themselves excluded from future opportunities.

This reputation based model proved highly effective. As confidence in the platform grew, transaction sizes increased. Deals that once involved a few hundred dollars began reaching five and six figures, covering assets such as large social media pages, established websites, and premium domains.

Importantly, the community itself played a role in enforcement. Experienced members regularly flagged suspicious listings, offered guidance to newcomers, and helped resolve conflicts. This reduced the burden on administrators and reinforced a shared interest in maintaining standards.

From forum to marketplace

As transaction volume grew, SWAPD began to formalize its operations. Escrow services were introduced via partnerships like Trustap.com, to protect both buyers and sellers. Payments were held until assets were verified and transferred, significantly reducing fraud.

The platform also implemented stricter verification processes. High value sellers were required to prove ownership of assets. Buyers underwent identity checks for larger transactions. These measures increased compliance and made the marketplace more accessible to professional participants.

Eventually, SWAPD transitioned into operating as a Merchant of Record. This shift meant that the platform itself became responsible for processing payments, handling taxes where applicable, and managing regulatory requirements. For users, this added a layer of legitimacy and convenience that was previously unavailable in this segment of the digital economy.

According to figures shared by the platform and its partners, cumulative sales facilitated through the SWAPD ecosystem have now surpassed 60 million USD. This figure includes a wide range of asset types and transaction sizes, reflecting the breadth of the market the platform serves.

Why the model worked

The success of SWAPD cannot be attributed to technology alone. Its core advantage was cultural rather than technical. By prioritizing trust, transparency, and long term participation, the platform created an environment where high value commerce could occur organically.

Unlike many startups, SWAPD did not rely on heavy marketing or rapid user acquisition. Growth was largely driven by word of mouth within online trading communities. Each successful transaction reinforced confidence and attracted new participants.

The forum format itself also played a role. Public discussions allowed buyers to ask detailed questions and sellers to explain their offerings. This level of openness reduced information asymmetry and led to more informed transactions.

In addition, the platform remained focused on a specific niche rather than attempting to become a general purpose marketplace. By serving users who understood the value of digital assets, SWAPD avoided many of the pitfalls associated with mainstream platforms unfamiliar with this type of commerce.

A reflection of a broader trend

SWAPD’s rise comes at a time when digital assets are gaining increased recognition as legitimate forms of property. Social media accounts are being bought by brands, domains are traded as investments, and online audiences are treated as measurable business assets.

At the same time, trust in large centralized platforms has declined. Sellers are increasingly wary of sudden policy changes, account freezes, and opaque enforcement. Community driven marketplaces offer an alternative where rules are clearer and governance is more transparent.

The success of SWAPD suggests that there is room for platforms that blend old internet forum culture with modern compliance and payment infrastructure. Rather than replacing traditional marketplaces, these platforms complement them by serving specialized markets with unique needs.

Looking ahead

As regulatory scrutiny around digital commerce increases, platforms like SWAPD face new challenges. Compliance requirements, data protection laws, and payment regulations continue to evolve. Operating as a Merchant of Record places additional responsibilities on the business, but also positions it for long term sustainability.

Industry observers note that the platform’s community centric roots may give it an advantage. Users who have invested time and reputation into the ecosystem are more likely to adapt to new rules and support necessary changes.

Whether SWAPD continues to scale or remains a focused niche marketplace, its story offers valuable lessons. It demonstrates that meaningful economic value can be created without massive funding, aggressive growth tactics, or complex technology stacks.

Instead, it shows that trust, when designed into a system from the beginning, can compound over time. A small forum, built with care and discipline, can become the foundation for tens of millions of dollars in commerce.

In a digital economy often defined by scale and speed, SWAPD stands as a reminder that community still matters.