South Korea’s exports are on track for their fastest annual increase in more than four years, powered by surging global demand for AI-related semiconductors and a calendar boost from more working days compared with last year, according to economists and early customs data.

A Reuters poll of 11 economists expects exports in January to rise 29.9% year-on-year — the strongest pace since November 2021 — as chipmakers benefit from heavy AI infrastructure spending by global cloud and data-center operators.

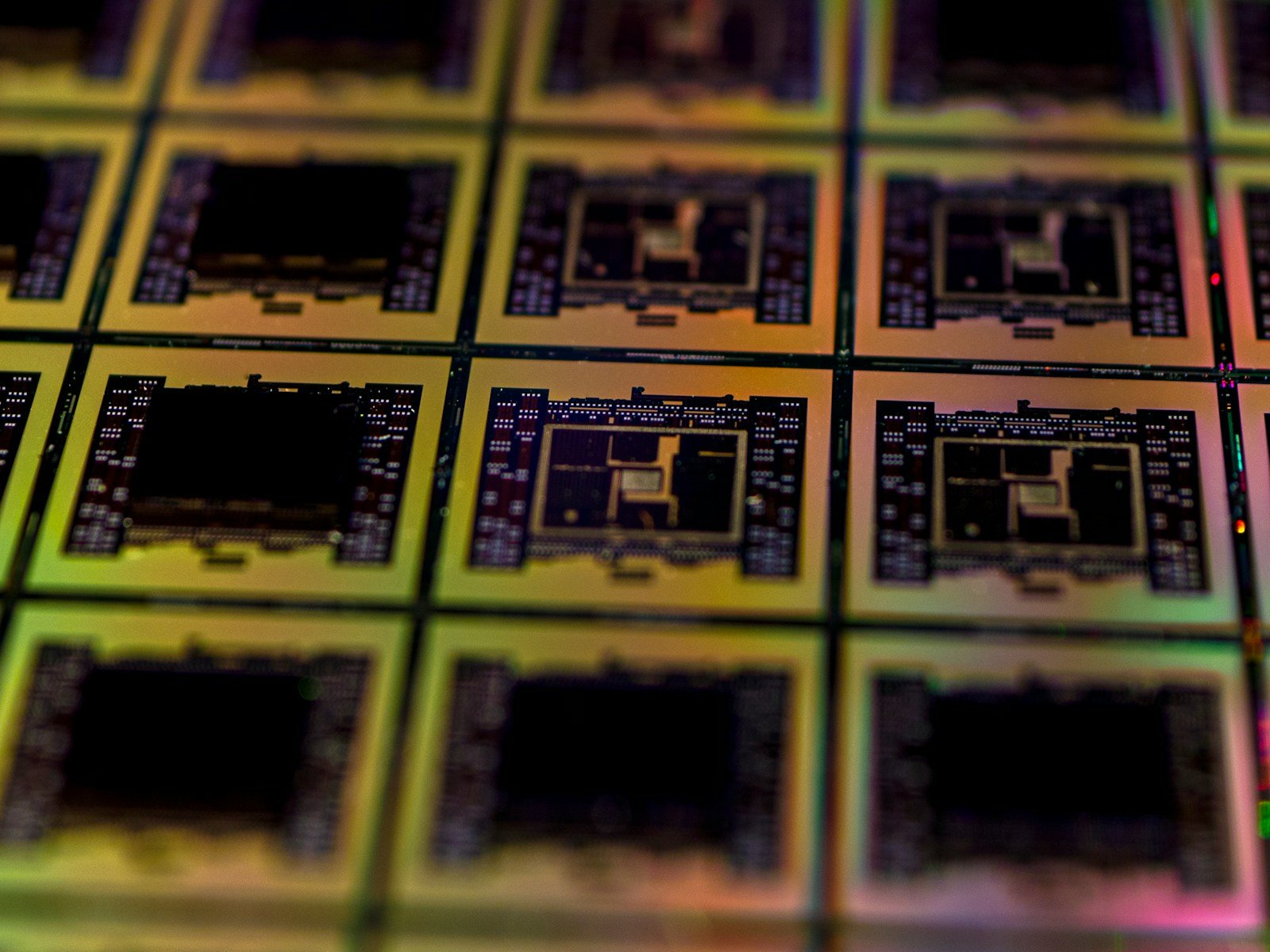

The strength is already visible in early figures. Korea Customs Service data for the first 20 days of January showed total exports up 14.9% from a year earlier, with semiconductor exports surging 70.2% to $10.73 billion. Chips made up 29.5% of total exports in that period, up 9.6 percentage points year-on-year, underlining how central semiconductors have become to South Korea’s trade rebound.

By destination, early exports to China rose 30.2% and shipments to the United States increased 19.3%, suggesting demand is broad-based even as companies navigate trade and policy uncertainty.

The chip surge is also masking weakness in other areas. Economists cited by Reuters noted that autos and ship exports have been softer, making semiconductors the key offset keeping headline export growth strong.

One economist highlighted the scale of the AI-led cycle: “We continue to expect semiconductor export growth to rise to around 70% year-on-year in 2026, versus 22% in 2025, led by the global AI capex cycle,” said Kim Jin-wook, an economist at Citi.

Imports are also expected to rise sharply — projected at 14.6% — which would be the biggest increase since September 2022, reflecting stronger domestic demand and higher inbound volumes of industrial inputs. The January trade surplus is forecast at $4.60 billion, smaller than December’s $12.17 billion, as imports catch up.

South Korea’s government has already raised its 2026 GDP growth forecast to 2.0% from 1.8%, citing stronger chip demand, while the Bank of Korea has also flagged upside risks to its own 1.8% projection. Official January trade figures are scheduled for release on February 1.