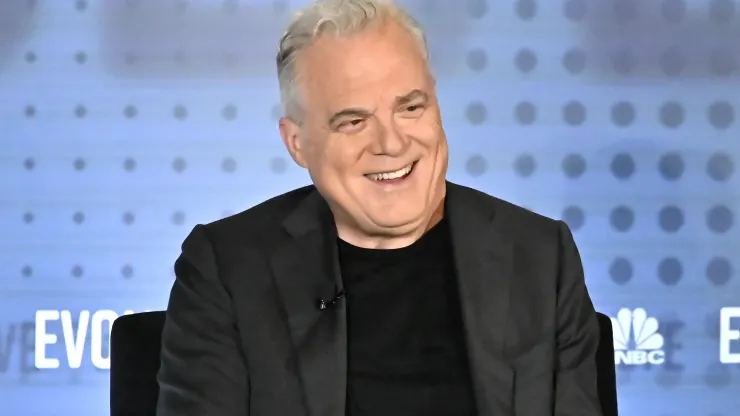

Mark Bertolini has steered Oscar Health toward profitability since becoming CEO a year ago. Now, he’s focusing on expanding the health insurer’s footprint in the employer market. This strategy targets the 71 million lives covered by small group and middle market employers, where Bertolini sees an opportunity to innovate.

Currently, many employees are over-insured to ensure coverage for the few who are seriously ill, leading to high premiums. Bertolini plans to introduce tailored plan designs and underwriting to better match employees with the right coverage, creating what he describes as an “ultimate flexible benefit plan.”

This approach isn’t new but has lacked traction due to insurers’ previous failure to control costs for employers and employees. By focusing on affordability and appropriate coverage, Bertolini aims to invigorate the market for individual coverage health reimbursement arrangements (ICHRAs), which allow employers to give workers funds to buy their own plans through Affordable Care Act exchanges.

Oscar’s ambition is to grow its membership from 1.5 million to 4 million by 2027. The company has set a goal of achieving around 20% annual revenue growth over the next three years and targeting earnings of $2.25 per share by 2027.

Bertolini, who previously led Aetna for eight years, brings extensive experience in managing large insurers and pharmacy benefit managers (PBMs). Under his leadership, Oscar negotiated better terms with CVS Health’s Caremark division, helping to control medical costs. This contract runs through 2026, and Bertolini is closely monitoring Blue Shield of California’s innovative PBM model, which seeks to reduce costs through partnerships with smaller PBM firms, Mark Cuban’s Cost Plus Drugs, and Amazon Pharmacy.

Bertolini believes the traditional PBM model needs reform. He advocates for PBMs to be transparent with customers and pass on savings generated from their scale directly to them. This approach, he argues, could sustain the PBM industry’s relevance.

The three major U.S. PBMs — CVS’s Caremark, Cigna’s Express Scripts, and UnitedHealth Group’s Optum Rx — are under increasing regulatory scrutiny and have started adopting more transparent pricing models.

As Oscar Health moves forward, Bertolini’s strategy to tap into the employer market and innovate within the PBM space is poised to drive significant growth and reshape how health insurance is provided to employees across the U.S.

READ MORE: