Nike’s CEO, John Donahoe, is under increasing scrutiny after the company reported disappointing fiscal results, leading to a sharp decline in its stock price. On Thursday, Nike warned that its sales for the current quarter are expected to decline by 10%, significantly worse than the 3.2% drop projected by analysts. This follows the company’s slowest annual sales growth in 14 years, excluding the pandemic period. The news caused Nike’s shares to plummet by 20% on Friday, erasing approximately $28 billion from its market cap.

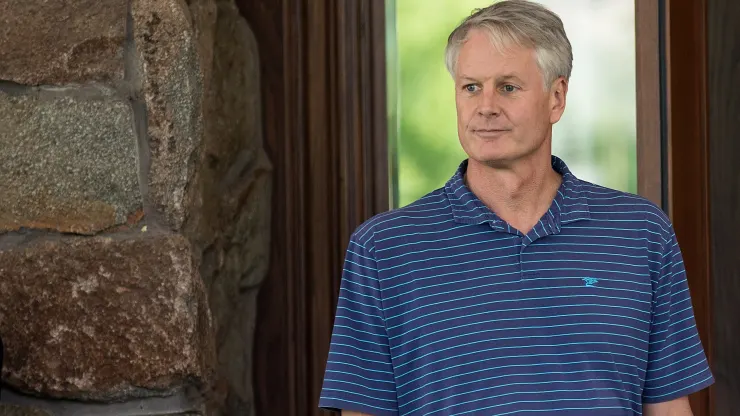

Wall Street’s reaction was swift, with at least six investment banks downgrading Nike’s stock. Analysts, including those from Morgan Stanley and Stifel, have begun questioning the company’s management. Jim Duffy, an analyst at Stifel, highlighted the repeated downward revisions in Nike’s projections and suggested that the credibility of the management is severely challenged. Since Donahoe took over as CEO in January 2020, Nike’s stock has declined by more than 25%, underperforming the S&P 500 and retail-focused ETFs.

Nike’s financial chief, Matt Friend, attributed the recent guidance cut to various factors, including softness in China and unfavorable foreign exchange rates. However, some issues are seen as stemming from decisions made under Donahoe’s leadership. The company has struggled with slow wholesale orders, a shift in consumer preferences, and a focus on direct-selling strategies that have strained relationships with key retail partners. Additionally, Nike’s core sneaker lines, such as Air Force 1s and Air Jordan 1s, have lost appeal, leading customers to seek innovative designs from competitors like On Running and Hoka.

Analysts argue that Nike has missed key consumer trends, particularly the post-pandemic surge in running. Jessica Ramírez, a senior research analyst at Jane Hali & Associates, emphasized the need for a management change, noting that Nike failed to respond to the increased interest in running. Kevin McCarthy, a senior research analyst at Neuberger Berman, echoed these sentiments, suggesting that Donahoe’s tenure might soon end.

Despite the challenges, Nike’s founder and chairman emeritus, Phil Knight, expressed his support for Donahoe. Knight stated that he believes in Nike’s future plans and has full confidence in Donahoe’s leadership. Under Donahoe, Nike’s annual sales have grown from $37.4 billion in fiscal 2020 to $51.36 billion in fiscal 2024. However, the company’s current struggles and management’s ability to adapt to changing market conditions remain critical concerns for investors and analysts.

READ MORE: