In May, U.S. monthly inflation remained unchanged as a slight rise in service costs was counterbalanced by the most significant drop in goods prices in six months, potentially bringing the Federal Reserve closer to reducing interest rates later this year. According to the Commerce Department, consumer spending saw a marginal increase last month, and underlying prices advanced at their slowest pace in six months. This development has fueled optimism that the U.S. central bank could achieve a “soft landing” for the economy, where inflation cools without triggering a recession or a sharp rise in unemployment. Following this news, traders increased their bets on a Fed rate cut in September.

“This report is very favorable for the Fed and suggests that a rate cut in September is likely,” said Scott Anderson, chief U.S. economist at BMO Capital Markets. “The sharp slowdown in core inflation is exactly what was needed to keep the economy on a soft-landing path.”

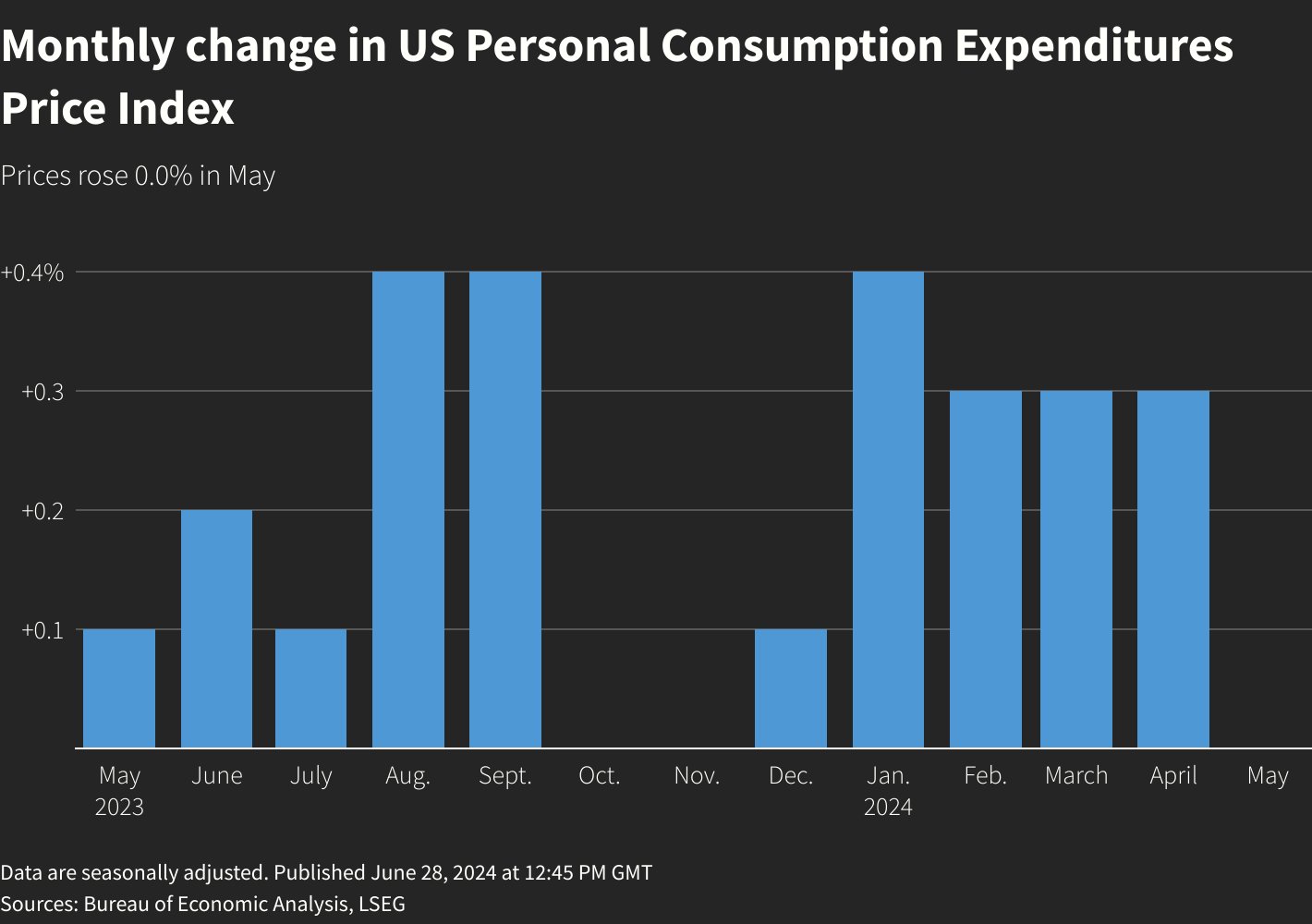

The personal consumption expenditures (PCE) price index showed a flat reading in May after a 0.3% increase in April. This was the first time in six months that PCE inflation was unchanged. Goods prices fell by 0.4%, the most significant drop since November, with notable declines in recreational goods, vehicles, furnishings, and durable household equipment. Gasoline and other energy goods saw a 3.4% decrease, while clothing and footwear prices also declined. Conversely, food prices rose marginally, and service costs increased by 0.2%, driven by higher prices for housing, utilities, and healthcare.

Over the 12 months through May, the PCE price index rose by 2.6%, following a 2.7% increase in April. These figures align with economists’ expectations. Inflation has been receding since the first quarter, aided by 525 basis points of rate hikes by the Fed since 2022 to cool domestic demand. However, inflation remains above the central bank’s 2% target. Financial markets now see a 68% chance of the Fed starting to ease policy in September, up from 64% before the data release.

Economists are divided on whether the Fed will reduce borrowing costs twice this year amid solid wage growth. The upcoming U.S. employment report for June, due next Friday, could provide further insights into the monetary policy outlook.

Excluding volatile food and energy components, the core PCE price index edged up by 0.1% in May, the smallest gain since November, after a 0.3% rise in April. On a year-over-year basis, core inflation increased by 2.6%, the smallest advance since March 2021, down from 2.8% in April.

Consumer spending, accounting for over two-thirds of U.S. economic activity, rose by 0.2% in May, supported by a 0.3% gain in services spending, mainly on hospital care, housing, utilities, and air transportation. Goods spending rebounded by 0.2%, lifted by outlays on prescription medication, recreational goods, vehicles, and clothing. Personal income increased by 0.5%, with wages rising by 0.7%, potentially concerning policymakers.

Despite inflation fatigue, higher borrowing costs, and dwindling savings, consumer spending remains supported by a resilient labor market, generating strong wage gains. Inflation-adjusted spending rebounded by 0.3%, keeping growth in consumption this quarter on track to match the first quarter’s 1.5% pace. The Atlanta Fed estimates a 2.2% rise in gross domestic product for the second quarter, following a 1.4% growth rate in the first quarter.

READ MORE: